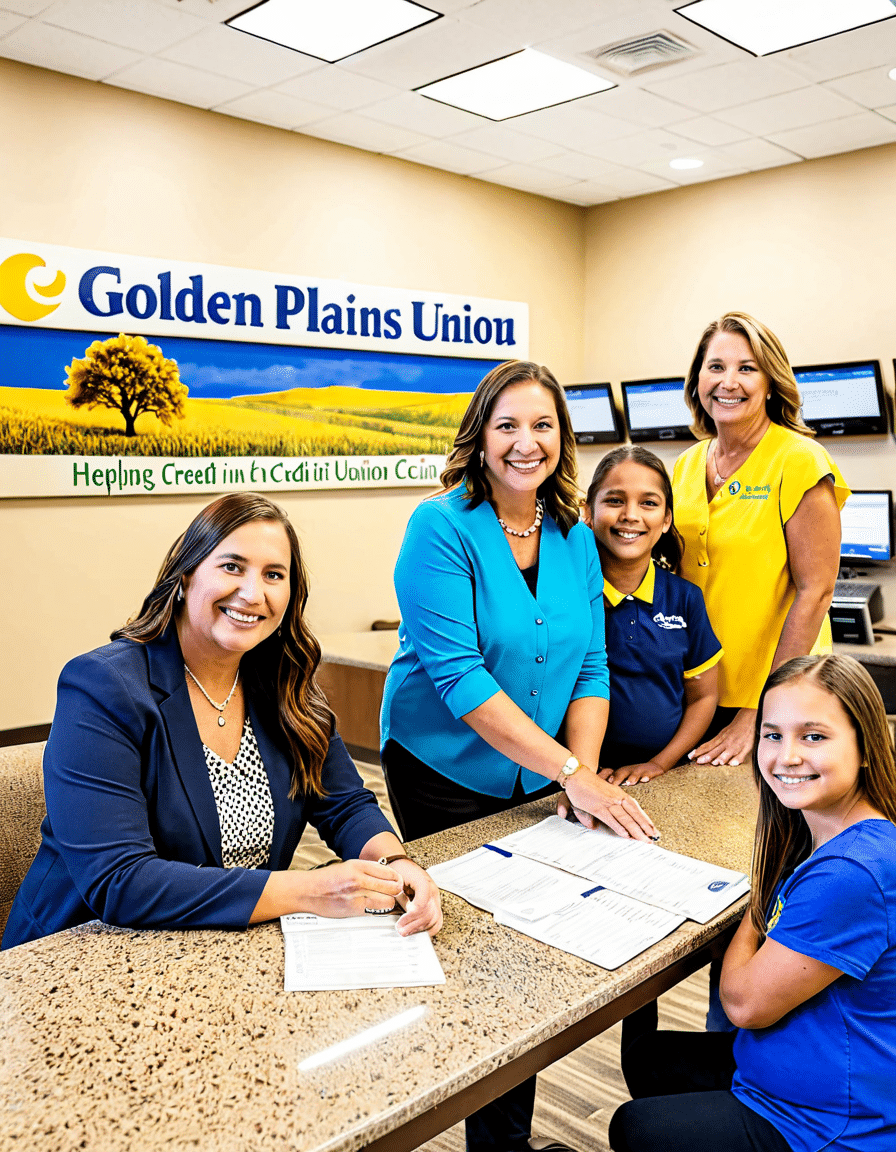

Golden Plains Credit Union (GPCU) stands tall as a beacon of hope and innovative problem-solving in community development. With a mission that prioritizes the financial and overall well-being of local residents, GPCU has become a vital part of the fabric of the communities it serves. From unique financial literacy programs to partnerships that promote health and wellness, Golden Plains Credit Union sets a standard for what a credit union can achieve.

GPCU is not just about banking; it’s about building a strong community. By focusing on collaboration between residents, businesses, and local organizations, GPCU creates initiatives that resonate. Whether it’s a program that helps young adults learn about budgeting or support for local entrepreneurs, their impact is undeniably profound.

So, let’s dive into the top initiatives making waves at Golden Plains Credit Union in 2024 and how they compare to similar efforts by other organizations!

Top 5 Community Initiatives by Golden Plains Credit Union in 2024

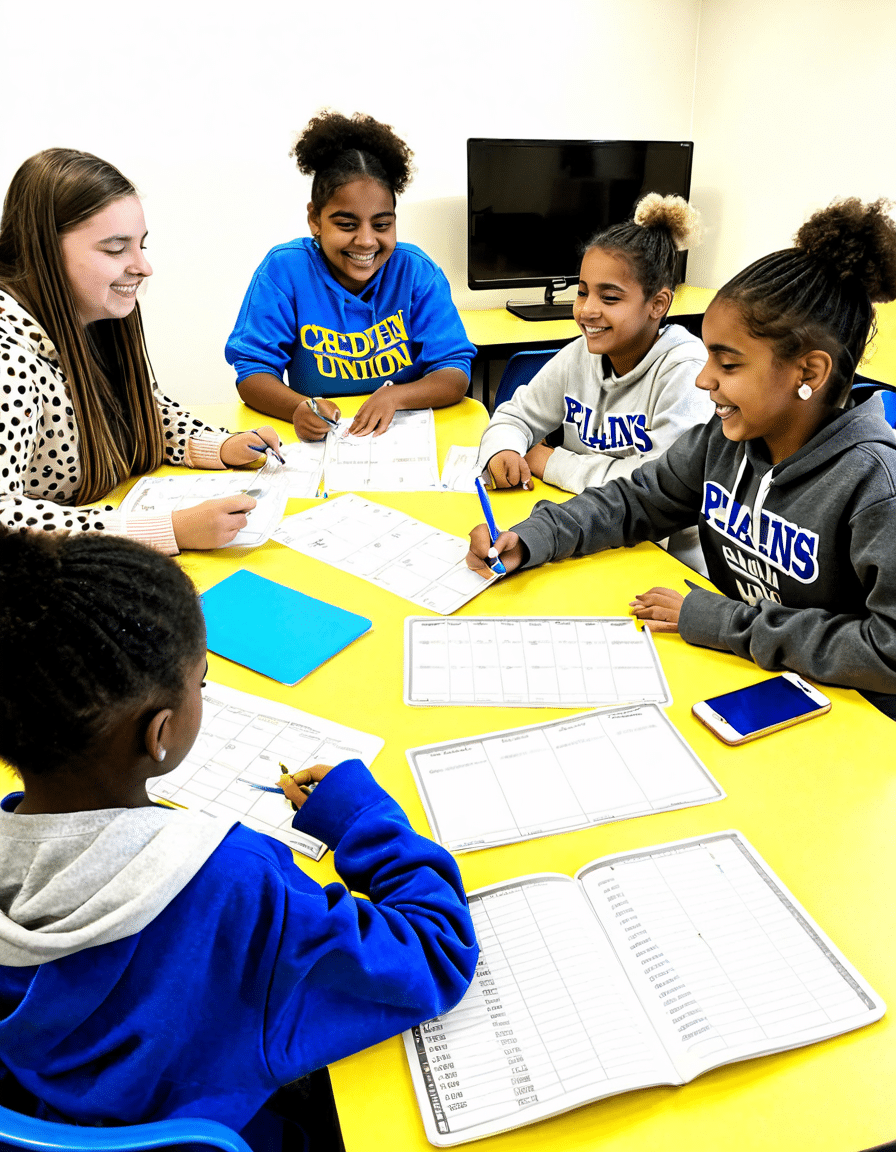

GPCU rolls out free financial education workshops accessible for every age group. Tackling essentials like budgeting and credit management, these sessions empower residents to make savvy financial choices. It’s akin to the successful workshops offered by OnPoint Community Credit Union in Oregon, particularly engaging community members to foster financial confidence and resilience.

With its Small Business Grant Program, Golden Plains Credit Union goes beyond mere loans. They provide funding and invaluable resources for local startups, following in the footsteps of Pima Federal Credit Union, who emphasize similar entrepreneurial support. This not only stimulates economic growth, but it also uplifts community spirits and breathes life into local economies.

Collaborating with CenterWell Home Health is among GPCU’s outstanding initiatives. Health-focused community events provide essential screenings and wellness programs, reinforcing the idea that financial and physical health are intertwined. The holistic support ensures that community members lead balanced, healthy lives, bridging gaps that traditional banking systems often overlook.

GPCU launched a Community Impact Fund, a groundbreaking initiative that uses a slice of their profits for local development projects, including education and infrastructure. Drawing inspiration from White Oak Capital Partners, GPCU’s approach to sustainable investment signifies commitment to long-term community welfare. It’s a clear indicator of how GPCU believes in reinvesting in the places their members call home.

GPCU’s efforts culminate in its proactive stance on youth development. By offering scholarships and internships to local high school students, they’re investing in tomorrow’s leaders today. This initiative resonates with the programs seen in various credit unions embracing mentorship, ensuring individuals have the support and skills needed for successful futures.

Comparing Golden Plains Credit Union with Other Credit Unions’ Community Efforts

Let’s take a closer look at how Golden Plains Credit Union’s initiatives stack up against the community efforts of others. When we hold GPCU up against OnPoint Community Credit Union, Pima Federal Credit Union, and White Oak Capital Partners, we see both shared goals and distinctive methods.

The Future of Community Solutions at Golden Plains Credit Union

Looking ahead, it’s clear that Golden Plains Credit Union will continue to push boundaries toward innovation and sustainability. As they step into 2025, the focus will likely shift towards blending technology with community services. Collaborating with fintech innovators can unlock a treasure trove of possibilities and efficiency, ensuring broad access to financial services for every community member.

What’s more, GPCU has shown a consistent willingness to adapt and embrace new methods, showcasing their forward-thinking approach. The impact they’ll create in partnership with their neighborhood will certainly pave the way for even more significant contributions.

Impactful Wrap-Up

Golden Plains Credit Union proves time and again that they are more than just a financial institution; they are crucial players in the promotion of community development. By fostering essential partnerships and investing in financial education, GPCU creates a resilient framework for economic stability and well-being.

As they continue to evolve alongside other prominent organizations, the potential for greater impact expands. Credit unions like GPCU set an empowering example of collective responsibility and innovative solutions, showing just how tethered our financial choices can be to the health and happiness of our communities. Here’s to Golden Plains Credit Union, a true champion of the community!

Through community development and initiatives, GPCU demonstrates that they are “in it together” with the people they serve, forever aiming for an enriched future for all.

Golden Plains Credit Union: Fun Trivia and Interesting Facts

A Community Hub with Purpose

The Golden Plains Credit Union is more than just a financial institution; it acts as a vital community hub. Many folks don’t realize that credit unions, like Golden Plains, are not-for-profit organizations, meaning any surplus earnings often get returned to members in the form of better rates and lower fees. Speaking of financial tools that might interest savvy consumers, did you know the Bovada App is gaining traction for its range of betting options? The similarities between gaming and finance are often more profound than one may think!

Support When It Counts

Another fascinating aspect of Golden Plains Credit Union is its commitment to local resilience. They’ve rallied together in times of hardship, such as with severe weather events highlighted by Storm Debi weather Warnings. While many people might feel overwhelmed during such trying times, local institutions play a crucial role. The credit union often steps in to provide immediate assistance, which strengthens community bonds and support systems. Just like how a skincare fridge can store essential items, a community institution like this keeps the foundation of local support fresh and readily accessible.

Collaborations and Expansion

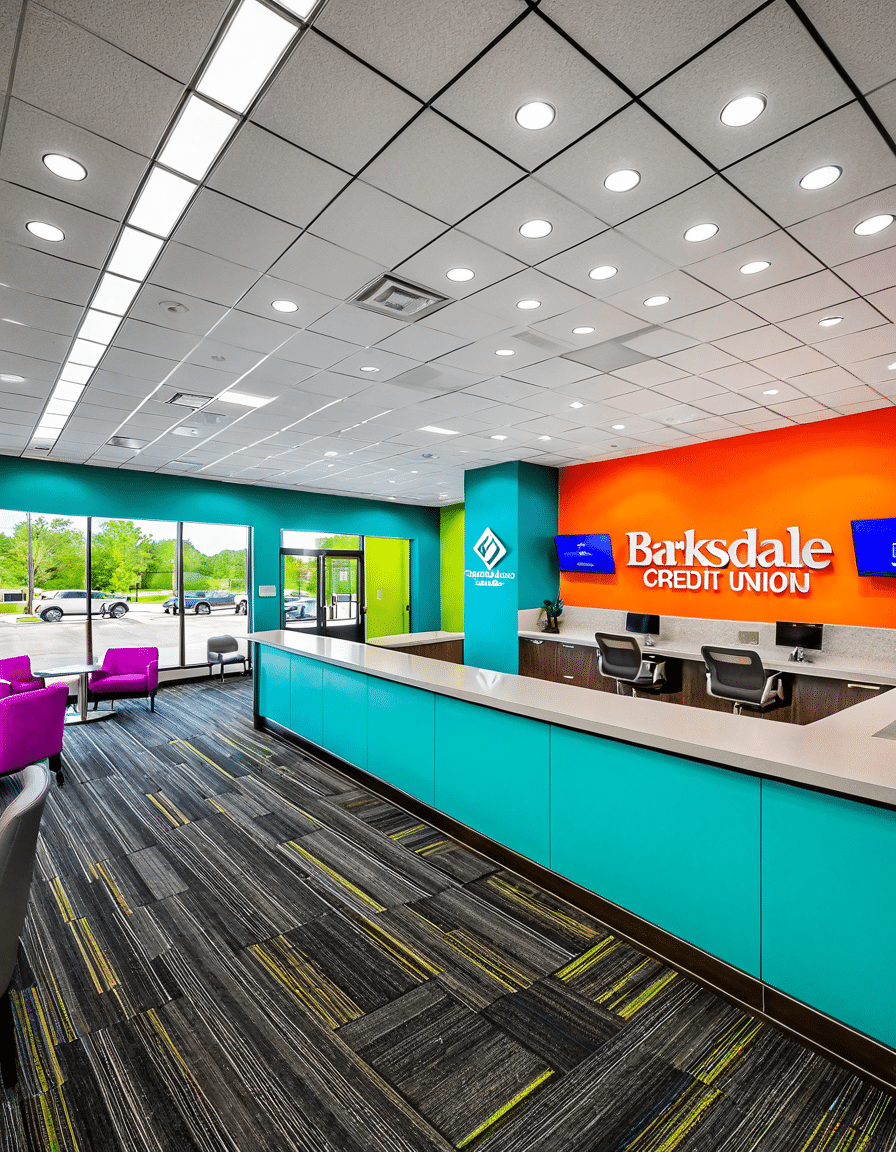

Golden Plains Credit Union also thrives on collaboration. By partnering with organizations like Kohler Credit union and Barksdale Federal credit union, they can develop services that better cater to members’ needs. Such partnerships show how connectivity within the credit union system can amplify benefits for individuals and families alike. Interestingly, a recent film called Colitas illustrates how shared experiences can cultivate a sense of community and belonging, much like Golden Plains does with its members.

Moreover, the credit union’s efforts to educate its members about wealth management could leave a lasting impact. Financial literacy is key to empowering individuals, helping them navigate their financial journeys with confidence. Just as you might check Scott Adams’ Twitter for insightful advice or news, staying informed about personal finance can prove equally invaluable. Through engaging programs and accessible resources, Golden Plains Credit Union stands at the forefront of enhancing community well-being.